Jacob Faber was waiting in line outside the Whole Foods at the corner of Bowery and East Houston in lower Manhattan this past April, when he heard two security guards talking about their checks from the economic relief package President Donald Trump signed on March 27.

One guard said his money was directly deposited into his bank account, recalls Faber, an associate professor at New York University’s Robert F. Wagner School of Public Service. The other said he took his check not to a bank, but to a well-known tax preparation provider.

The first guard used the kind of checking-and-savings bank millions of Americans use. The second turned to an institution many academics — and federal agencies — consider to be part of the alternative financial service universe that comprises rent-to-own stores, money transmitters, check cashers, car title lenders, pawnshops and payday lenders.

As the coronavirus downturn stretches into mid-2020 with historic unemployment rates, low- and middle-income Americans may increasingly turn to alternative financial services for cash to pay for food, shelter and other essentials. Academic research shows these services primarily cluster in black and Hispanic neighborhoods — and rural areas with a dearth of traditional banking.

“A lot of headlines now are saying we are going to be in something that is comparable to the Great Depression,” says Faber, who studies economic, racial and spatial inequality. “The role these alternative financial services are going to play in how the recovery is felt is a really important question.”

Traditional banking

When a supermarket clerk puts his paycheck into his checking account, he’s depositing money into the federally insured banking system. The Federal Deposit Insurance Corporation, an independent agency of the U.S. government, insures bank deposits up to $250,000. If the checkout clerk has $1,000 in his account and his bank fails, he’ll get his money back.

There are roughly 5,200 FDIC-insured commercial banks and savings institutions in the U.S. Bank of America, JPMorgan Chase, Wells Fargo, Citibank and U.S. Bank are the five biggest, with a combined $5 trillion in deposits — representing about 38% of deposits at FDIC-insured institutions as of June 2019.

Traditional banks also offer customers financial products beyond deposit accounts, from home mortgages to car loans to business and personal loans. But they don’t, by and large, offer the short-term, small-sum loans and other services for people with no or poor credit that typify alternative financial services.

The alternative financial services universe: Non-loans, secured loans and unsecured loans

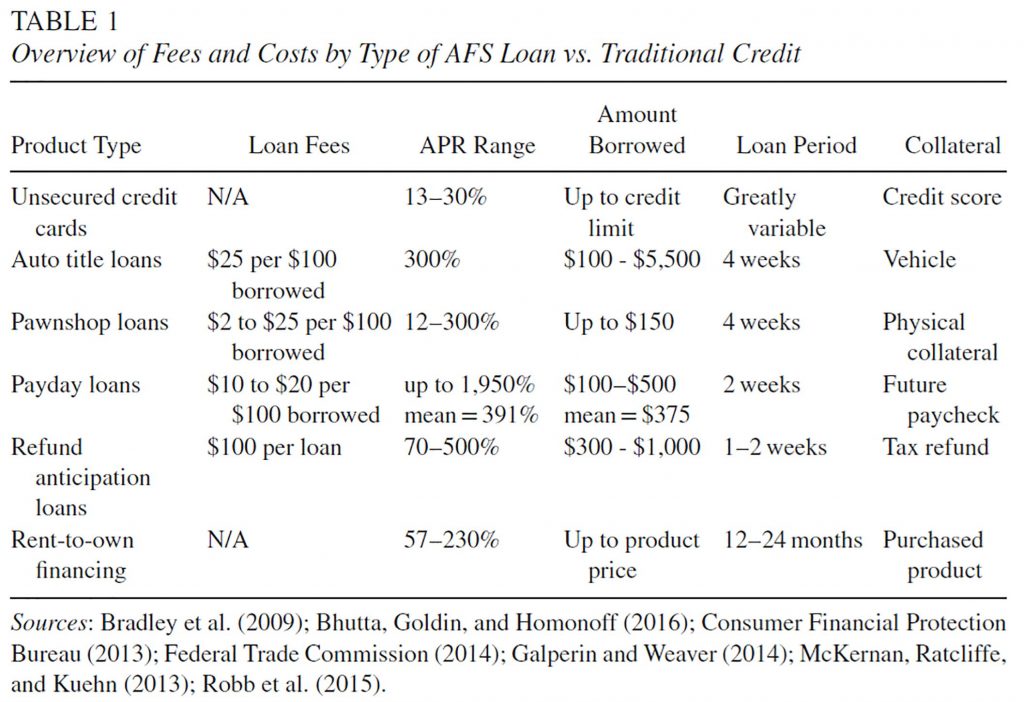

The universe of alternative financial services can be broken into three broad categories: non-loan services, secured loans that require collateral, and unsecured loans. Many of these products are available online — and, as states reopen their economies, at brick-and-mortar locations. Several states deemed pawnshops and payday lenders essential businesses, and they’ve been open during the lockdown.

Rent-to-own stores, money transmitters and check cashing outlets are examples of non-loan alternative financial services. Rent-to-own stores offer furniture, appliances and other household goods in exchange for a monthly payment, with interest. Money transmission services send money from one party to another for a fee. Check cashing services give customers cash for paychecks or personal checks. They usually charge a fee of 1% to 4% of the check’s face value, according to the FDIC.

Traditional banks, by contrast, cash checks for free for customers. Nearly a quarter of unbanked households turn to check cashers, according to 2017 results from a 35,000-household survey the FDIC conducts every two years. Unbanked households are those without an account at an FDIC-insured institution. Underbanked households are those that have a checking or savings account but still use alternative financial services.

Some 6.5% of U.S. households are unbanked and 18.7% are underbanked, the FDIC survey data show. Results from the 2019 survey are due out this fall, an FDIC spokesperson told Journalist’s Resource.

Money transmission services are often associated with remittances — money sent from foreign nationals working in the U.S. to their families in other countries. Remittances from the U.S. topped $68 billion in 2018, according to the World Bank, a financial cooperative of 189 countries. The World Bank warns of a 20% decline in global remittances in 2020 because the coronavirus pandemic has led to falling wages and employment for migrant workers. Banks typically don’t provide remittance services and the international money transfers they do provide can be expensive, according to the Congressional Research Service.

Secured loans require collateral. Car title lenders accept car titles as collateral. If someone takes out a car title loan and misses payments, the lender may repossess the car. Pawnshop loans are also secured loans. Customers take things of value to a pawnshop as collateral for a loan. That thing of value — a diamond ring, a gold chain — becomes pawnshop property if the borrower doesn’t repay the loan.

Other loans don’t require a physical item as collateral. Some tax preparation services, for example, allow customers upfront access to part of an expected tax refund through products called refund anticipation loans or refund anticipation checks. These products usually come with interest, fees or both — on top of preparation fees — that are repaid, along with the advanced money, when the customer’s refund comes through. U.S. Census Bureau economist Maggie Jones writes in a 2016 report that tax preparers sometimes take their cut from the money low- and middle-income households receive through federal tax credits.

The biennial FDIC household survey counts refund anticipation loans as part of the alternative financial services universe. Academics often classify tax preparers as alternative financial service providers in part because anyone making less than $56,000 a year is entitled to free in-person tax preparation at Volunteer Income Tax Assistance sites. People making less than $69,000 can file their taxes for free through a variety of online, nationally known tax preparation services. People over age 60 are also entitled to free help for retirement-related tax questions. Still, taxpayers may not be aware they’re entitled to free filing and preparation services.

“There’s a very simple reason to include them, which is that they are providing a service that is free to many other people,” Faber says. “It’s not free to their customer base, who tend to be poorer.”

Payday loans are another type alternative financial service product. A payday loan is an advance on a paycheck. People who need cash before their next paycheck might go to a payday lender to immediately get a portion of their expected paycheck. When the paycheck comes through, the lender takes back the amount of the advance — plus fees.

Some 12 million Americans use payday loans each year, according to a widely cited 2016 report from the Pew Charitable Trusts. The average payday borrower takes out eight loans yearly totaling $375, incurring $520 in interest. Academic researchers have documented payday, auto title and pawnshop lenders that charge more than 300% annual interest.

Unsecured loans don’t require collateral. They’re typically short-term installment loans paid back over several months or years. More on these loans later.

Researchers say it’s not accurate to think of traditional banking and alternative financial services as a tale of two cities. People with traditional bank accounts may also use alternative financial services. And certain bank fees can be as usurious as non-bank loans.

“I think of financial services on a continuum,” says University of Michigan associate professor Terri Friedline, who studies financial consumer protection. “We tend to dichotomize ‘alternative’ versus ‘mainstream.’ I think ‘continuum’ is an accurate descriptor because banks do things that are predatory, too. They tend to be lower cost and higher quality relative to a 400% interest rate on a payday loan. But an overdraft fee is essentially the same. The average rate to trigger an overdraft is $4 — so if you pay $35 on that overdraft, you’re paying the same interest.”

Who uses alternative financial services?

There is a raft of academic research from the past decade on who uses alternative financial services, and the consequences of using financial products outside the FDIC-insured banking system.

Here’s a sample:

- Payday loan usage nearly doubled in 2013 compared with 2007, following the Great Recession, as households that lacked other credit options turned to payday loans to settle everyday bills, according to the study, “The Increase in Payday Loans and Damaged Credit after the Great Recession,” published in November 2017 in the Journal of Family and Economic Issues.

- After controlling for socio-demographics, home ownership and financial education, researchers find that people who use alternative financial services tend to be racial minorities, male, rent their homes or apartments and live with a partner. They tend to be between 18 and 34 years old and have limited incomes and financial education, according to “The Association of Alternative Financial Services Usage and Financial Access: Evidence from the National Financial Capability Study,” from August 2015 in the Journal of Family and Economic Issues.

- A higher concentration of alternative financial services in a community is associated with a higher likelihood that middle- and high-income people had ever used them, and with more chronic use among low-income people, according to “Does Community Access to Alternative Financial Services Relate to Individuals’ Use of These Services? Beyond Individual Explanations,” from August 2016 in the Journal of Consumer Policy.

- There are more payday lenders and money transmitters in counties with large black populations. Check cashers are more common in counties in the Northeast and West that have large black populations, while pawnshops are more concentrated near Native American reservations, according to “The Geography of Fringe Banking” from August 2014 in the Journal of Regional Science.

- Use of alternative financial services in metropolitan areas is associated with higher rates of mortality after controlling for income, education and the size of the minority population, according to “Alternative Financial Services as a Social Determinant of Health in U.S. Metropolitan Statistical Areas” from August 2018 in the Journal of Health Disparities Research and Practice.

- Food insecurity is more likely in households that have children and that use check cashers and non-bank money orders, according to “Bank Accounts, Nonbank Financial Transaction Products, and Food Insecurity among Households with Children,” from November 2017 in the Journal of Consumer Affairs. For this paper, food insecurity means a household doesn’t have enough money to acquire adequate food for one or more of its members.

- People with disabilities are twice as likely as people without disabilities to use alternative financial services, according to “Living Outside the Financial Mainstream: Alternative Financial Service Use Among People with Disabilities,” from December 2018 in the Journal of Poverty.

Early evidence shows black and Hispanic workers have been harder hit by job losses during the coronavirus downturn than white and Asian workers. The unemployment rate in April 2020 was nearly 19% for Hispanic workers, 16.7% for black workers, 14.5% for Asian workers and 14.2% for white workers, according to the Bureau of Labor Statistics. The unemployment rate for American workers 25 years and older without a high school diploma was 20.9%, compared with 8.2% for workers in that age group with a bachelor’s degree.

Black people, Hispanic people and people who didn’t go to college are among those most likely to use alternative financial services. Nearly 40% of black households and 36% of Hispanic households in the 2017 FDIC survey reported using alternative financial services, compared with 18% of Asian households and 16% of white households. About 35% of homeowners or renters without a high school diploma use alternative financial services, compared with 15% of those with a college degree, the survey found.

Faber’s “Segregation and the Cost of Money: Race, Poverty, and the Prevalence of Alternative Financial Institutions” from December 2019 in Social Forces is one of the more recent papers to explore the relationship between neighborhood racial and economic makeup and alternative financial service providers.

It’s the first paper, according to Faber, to describe the national landscape of alternative financial services at the neighborhood level. Past research has typically relied on county-level data.

Using street addresses of every alternative financial service provider in in the U.S. in 2015, Faber shows their presence tends to decline as neighborhood income increases. The addresses are from marketing data firm Infogroup. Faber also documents the “unique vulnerability of even affluent blacks to institutional marginalization.” In other words, poor black and poor white neighborhoods have more in common when it comes to the prevalence of alternative financial services than wealthy white and wealthy black neighborhoods.

“The more I study alternative financial services, the more afraid I am about the role they are going to play in racial inequality and class inequality and inequality across immigration status and geography,” says Faber. “Just the growth of these services in parallel with banks leaving a lot of poor communities of color.”

Research findings are mixed on the so-called “spatial void hypothesis,” which posits that alternative financial service providers fill a void when traditional banks vacate or sidestep certain neighborhoods.

One paper from April 2014 in the Review of Industrial Organization by an economist at the Board of Governors of the Federal Reserve System finds alternative financial service providers “tend to locate in rural areas that have low per-capita densities of bank branches, and in both urban and rural areas where a significant portion of the population does not qualify for more mainstream (and less expensive) forms of credit.”

Faber explains that for urban areas, it’s not cut-and-dried that neighborhoods with alternative financial services necessarily lack traditional banks. The reason is that banks and non-bank financial service providers operate in commercial zones — where black people and Hispanic people are also more likely to live, he says.

“It’s not fair to say that there are no banks in communities of color in big cities,” Faber says. “But there are fewer banks, on average, than there are in white neighborhoods. And there’s more alternative financial services. It’s not an either-or. It’s very much that the environment is more complex than that.”

State regulations: Location, location, location

The Consumer Financial Protection Bureau is the federal agency that, in recent years, has attempted to ensure people using alternative financial services don’t get stuck with unmanageable debt. The agency’s 2017 rule requires, among other things, that lenders determine whether borrowers can afford payments and their basic expenses. The rule was set to take effect on August 19, 2019. But the agency has deferred compliance until Nov. 19, 2020.

The CFPB, FDIC and three other federal financial regulatory agencies issued a non-binding, non-regulatory statement in late March “encouraging banks, savings associations and credit unions to offer responsible small-dollar loans to consumers and small businesses in response to COVID-19.”

Absent federal regulation, the amount of interest an alternative financial service provider charges can hinge on where a customer lives. Before the pandemic, some states capped interest rates, fees and loan amounts for certain kinds of loans.

The National Conference of State Legislatures has a recent rundown of payday lending statutes by state. Maine, Utah, Wisconsin and Wyoming allow payday loans of any amount, according to the NCSL, a non-governmental organization that represents state legislatures. Many states cap payday loans at several hundred dollars. Five states — Arizona, Arkansas, Georgia, New Mexico and North Carolina — prohibit them entirely. So does Washington, D.C.

Some states also prohibit very high interest on unsecured, non-bank personal loans. Some don’t. Ten states allow lenders to charge 85% or higher annual interest on an unsecured, six-month loan of $500, according to a February 2020 report from the National Consumer Law Center, a nonprofit organization that does policy analysis and advocacy work on behalf of low-income and older adults in the U.S.

The nationwide median interest rate cap for those $500 loans is 38.5%.

“It’s very inconsistent from state to state,” says Carolyn Carter, NCLC deputy director. “Some states do a good job of protecting consumers from these exorbitant, high-cost loans and others do a terrible job. Others make no attempt at all.”

Four states — Ohio, New Mexico, Oklahoma and Mississippi — have caps well north of 100% annual interest for $500 unsecured loans paid back in installments over six months. Mississippi’s cap is the highest at 305%.

Delaware and Missouri don’t cap interest rates on those loans. Idaho, Utah and Wisconsin also don’t have caps, except for “unconscionability” — a “legal principle that bans terms that shock the conscience,” according to the report. North Carolina, Arizona, Vermont, Hawaii and New York cap interest rates for those $500 loans at or below 25%.

A few states in recent weeks have taken action to temporarily curb potentially high-cost loans, certain debt collection practices and provide other financial relief for their residents. Small-loan companies were deemed non-essential in New Mexico and ordered closed in early April. Wisconsin has warned payday and other small loan providers their licenses could be at risk if they make opportunistic hikes of their usual interest rates and fees. Overdraft and late credit card payment fees are waived in New York for those experiencing financial hardship due to the pandemic.

Specifics vary by jurisdiction, but California, Nebraska, Ohio, Massachusetts and Washington, D.C., have taken steps to stem some debt collection practices, like property repossession, threatening borrowers with lawsuits and garnishing economic relief checks. A federal judge in Massachusetts, however, struck down an emergency regulation aimed at banning certain debt collection calls and lawsuits in that state after a trade group challenged it.

‘A lot of shame and guilt’

Lisa Servon, department chair of city and regional planning at the University of Pennsylvania, spent three months in 2016 working part-time as a teller at a check casher in the South Bronx as part of a book project. She also worked full-time for two weeks as a teller and one week as a collector for a payday lender in Oakland, California, for the book.

Despite data showing alternative financial service customers tend to be low-income and have less financial education, Servon observed that many of her clients were middle-class and understood their loan terms.

“There are all these people who are just one income shock or emergency away from needing a loan like these because they don’t have a buffer,” Servon says. “Lots of people taking the loans had a college education and made $50,000, $60,000, $70,000 a year.”

National data indicate Americans across income levels have little or no savings. In late April, 41% of Americans said they couldn’t afford an unexpected $250 expense, according to a nationally representative survey of 1,018 U.S. adults conducted by the American Public Media radio program Marketplace.

Servon was also on a research team that put together a 2016 report based in part on interviews with 45 clients of online payday and installment lenders. The team included academics as well as analysts from MDRC, a nonprofit, nonpartisan policy research organization.

Servon said she recently reached out to eight of those customers to find out if they were turning back to payday loans during the pandemic. She said they weren’t yet. Some told her they would never take a high-cost payday loan again. But, Servon adds, “it might be worth it to reach out to them again in another month, when yet another paycheck doesn’t get paid.”

One interviewee featured in the MDRC report is married with two young children and had occasionally used payday loans to cover medical bills. She told the researchers that payday loans can be helpful, and the experience can even be pleasant. But for people who continually rely on them and have a hard time paying them off, “it can be kind of a vicious cycle,” she said. And even if a borrower can afford a payday loan, taking the loan in the first place can register an emotional and mental toll.

“A lot of shame and guilt comes from people who feel like they have done something wrong,” says Servon. “We have this bootstrap rhetoric where if you work hard and do the right thing, you should be able to make it. People turn that back on themselves and ask, ‘What did I do wrong?’”

Alternatives to the alternatives

Financial education can reduce use of alternative financial services, particularly payday lenders, says Melody Harvey, a national poverty fellow at the University of Wisconsin-Madison.

Harvey is author of “Impact of Financial Education Mandates on Younger Consumers’ Use of Alternative Financial Services,” published in January 2019 in the Journal of Consumer Affairs. Using 2012 and 2015 data from the National Financial Capability Study, she finds that high school students exposed to state-mandated financial education were four percentage points less likely to borrow from payday lenders in the next five years, compared with students who didn’t receive mandated financial education.

Today, 21 states mandate financial education, according to a February 2020 report from the Council for Economic Education, a nonprofit that promotes financial literacy for kindergartners through 12th-graders.

“I suspect that we may ultimately see an increase in alternative financial services use, but I think the extent of that increase will depend on the interplay of how states treat the institutions that provide these services as well as the availability of other options,” Harvey says.

In addition to improving financial education to steer consumers away from high-cost, non-bank loans, research from Pew Charitable Trusts points to banks and credit unions as potential venues that could offer small loans at better rates than non-bank lenders. Most banks don’t offer small loans because there hasn’t been explicit federal regulatory approval for them to do so, according to Pew.

Others have pointed to post offices as places that could offer financial products at better rates than non-bank lenders. One thing that makes post office banking attractive to some is that post offices are just about everywhere. They “have always been a part of nearly every zip code across the country,” University of California, Irvine law professor Mehrsa Baradaran wrote in the Harvard Law Review in 2014. “This fact, above others, makes postal banking a uniquely appealing idea.”

Though some alternative financial service products can trap customers in downward spirals of debt, what would happen if all the payday lenders and check cashers and pawnshops disappeared tomorrow?

Faber, the NYU professor, says it’s unclear if “people living in poor communities of color would be better off.”

Harvey says it’s about risk calculation — for some, payday loans are the best available solution for quick cash.

For Servon, the answer requires a wholesale reconsideration of why alternative financial services exist.

“We could eradicate all the payday lenders off the face of the earth and people still don’t have enough money to pay for food and shelter,” she says. “Rather than thinking of interest rates as too high or not, it’s, ‘Do people have the right financial products to achieve financial health?’ Everything should be looked at in the larger context of financial inclusion and financial health.”

Check out our other coronavirus-related resources, including tips on covering biomedical research preprints and a roundup of research that looks at how infectious disease outbreaks affect people’s mental health. Also, don’t miss our feature on rural broadband in the time of coronavirus.