In August, the U.S. Department of Housing and Urban Development proposed a rule critics say would make it harder for people to fight housing discrimination. The agency is proposing to change how it interprets the “disparate impact standard,” a legal principle used for decades in cases involving Fair Housing Act violations.

The FHA was enacted as part of the Civil Rights Act of 1968. Numerous discriminatory housing cases have hinged on the disparate impact standard, which prohibits housing practices that lead to discrimination against a protected class — even if the discrimination isn’t intentional.

“Protected class” refers to groups that federal law protects from housing discrimination based on race, skin color, national origin, sex, religion, family status and disability. State and local laws may cover additional classes. They may protect, for example, renters and buyers from discrimination based on sexual orientation.

One widely cited hypothetical scenario involving the disparate impact standard is a landlord who screens out rental applicants with arrest records. This practice, though not necessarily intentionally discriminatory, could have a racially discriminatory effect because, “African Americans and Hispanics are arrested, convicted and incarcerated at rates disproportionate to their share of the general population,” according to HUD general counsel guidance from 2016.

Public comments on the proposed rule closed late last week. HUD received more than 3,800 comments. Critics say the proposed rule would make it nearly impossible for people to bring civil action using the disparate impact standard. Supporters say it would allow housing-related businesses to pursue their goals without undue concern that litigation based on disparate impact might be brought against them.

The number of comments reflects a high level of public interest and the proposed rule’s potential importance. By comparison, HUD sought public input on its Single-Family Loan Sale Program earlier this year and received 19 comments. In 2011, HUD issued a proposed rule — also on the disparate impact standard — and received just under 100 comments.

How would the proposed rule change HUD’s interpretation of the disparate impact standard?

HUD is a federal, cabinet-level agency founded in 1966 that, among other things, works to ensure fairness for people renting and buying housing. People can file complaints related to discriminatory housing practices through HUD’s Office of Fair Housing and Equal Opportunity.

This is how a discriminatory effect in housing is established today. It’s what HUD calls its “three-part burden-shifting test.” Federal courts of appeal often use a similar test. The Supreme Court introduced the idea of burden shifting in a 1973 ruling, and HUD’s test is modeled after it:

- The plaintiff has to prove that a practice, such as screening rental applicants for arrest records, caused or will predictably cause discrimination.

- The defendant then has the opportunity to prove that the practice is serving some non-discriminatory and legitimate interest, such as ensuring the safety of an apartment building’s residents.

- Even if the defendant meets that burden of proof, the plaintiff can prevail if the defendant could achieve their legitimate goal through another practice that leads to less discrimination.

Civil legal action requires that charging parties provide some basic facts that the defendant can rebut. This is called prima facie evidence. “Prima facie” is Latin for “at first sight.” Different legal actions require different prima facie evidence for a case to move forward.

The current rule is simple and broad at the prima facie phase — the plaintiff needs to show that a housing practice caused or will predictably cause discrimination. Under the proposed rule, the plaintiff would instead need to first allege something more specific — that the practice is “arbitrary, artificial and unnecessary” toward meeting a legitimate interest.

“HUD recognizes that plaintiffs will not always know what legitimate objective the defendant will assert in response to the plaintiff’s claim or how the policy advances that interest, and, in such cases, will not be able to plead specific facts showing why the policy or practice is arbitrary, artificial, and unnecessary,” writes Assistant Secretary for Fair Housing and Equal Opportunity Anna Maria Farías in the proposed rule. “In such cases, a pleading plausibly alleging that a policy or practice advances no obvious legitimate objective would be sufficient to meet this pleading requirement.”

In other words, if a housing policy or practice has no obvious goal that is enough to pass the “arbitrary, artificial and unnecessary” test. The burden would then shift to the defendant to show the policy or practice serves a valid interest. After the defendant has their say, burden shifts to the plaintiff, who must show that:

- There is a “robust causal link” between a practice and disparate impact on a protected class.

- HUD doesn’t precisely define “robust causal link,” but in its proposed rule the agency asks for comment on whether it should define that and other terms.

- The practice does indeed have a discriminatory effect on a protected class.

- The disparate impact is “significant” and not due to chance.

- The alleged discrimination is directly caused by the practice.

The plaintiff would have to show each of the above by a preponderance of the evidence. That means before the case goes to discovery, the fact finder — the person or people who decide whether a case should move forward — would have to be convinced there is a better than 50% chance each of the above is true.

Discovery is an important phase in litigation. It is when sides may take depositions and compel parties to provide documents and other information.

Getting to discovery means access to a potential wealth of evidence.

One other important change the proposed rule would make: a defendant can defeat a claim if unintentional discrimination is happening because of an algorithm that a “recognized third party, not the defendant, is responsible for creating or maintaining.” Farías explains in the proposed rule this is meant to allow defendants to stage a defense arguing the algorithm is an industry standard.

If the plaintiff were to win a case against a defendant using an unintentionally discriminatory third-party algorithm, the algorithm would only be removed from use “by one party, whereas suing the party that is actually responsible for the creation and design of the model would remove the disparate impact from the industry as a whole,” Farías writes. “A plaintiff may rebut this allegation by showing that the plaintiff is not challenging the standard model alone, but the defendant’s unique use or misuse of the model, as the cause of the disparate impact.”

Why did HUD propose this change?

Since the early 1990s, HUD has used the disparate impact standard to adjudicate housing discrimination charges, and 11 federal courts of appeal have agreed with the standard. But HUD only formalized its use of the disparate impact standard in a final rule from 2013. This is also the rule in which HUD codified its three-part burden-shifting test. Federal agency rules are often revisited after new presidential administrations and political appointees take office.

In its proposed rule from August, HUD heavily cites the Supreme Court’s 5-4 decision in Texas Department of Housing and Community Affairs v. Inclusive Communities Project, Inc. The Inclusive Communities Project, a fair housing nonprofit, alleged the state was doling out federal tax credits for affordable housing projects mostly in neighborhoods that were largely made up of racial and ethnic minorities, particularly in Dallas. According to the Inclusive Communities Project, this meant minorities were denied the chance to live in predominantly white neighborhoods — perpetuating housing segregation.

In the 2015 Inclusive Communities case, the highest court in the country affirmed that the disparate impact standard was legally viable, or “cognizable” in legal parlance. After Inclusive Communities, the disparate impact standard effectively became the law of the land.

Justice Anthony Kennedy, writing for the majority, stressed that businesses need to be able to make practical decisions without being overly concerned that those decisions might lead to legal liability under the disparate impact standard.

Kennedy, who retired in 2018, further clarified that a “robust causality requirement is important” to ensure defendants do not resort to racial quotas to avoid actual or potential discrimination. “Remedial orders that impose racial targets or quotas might raise difficult constitutional questions,” Kennedy writes. The Supreme Court has tackled racial quotas in several other cases, perhaps most notably in cases related to higher education. For example, the court barred racial quotas for college admissions in the landmark 1978 affirmative action case Regents of University of California v. Bakke.

According to HUD, the proposed rule brings the agency’s approach to the disparate impact standard in line with the Supreme Court’s Inclusive Communities decision.

Farías writes: “The Court placed special emphasis on the importance of the plaintiff’s prima facie burden, warning that, ‘[w]ithout adequate safeguards at the prima facie stage, disparate-impact liability might cause race to be used and considered in a pervasive way and would almost inexorably lead governmental or private entities to use numerical quotas, and serious constitutional questions then could arise.’”

What do critics say?

Critics of the proposed rule include members of the general public, elected officials and fair housing advocates. In their comments, critics argue that the proposed rule would make it difficult for people to file discriminatory housing claims based on the disparate impact standard.

“HUD’s proposal represents a major step backward because it would render the disparate impact standard a dead letter,” comments Ugochi Anaebere-Nicholson, directing attorney of the Public Law Center, which provides free legal representation to low-income residents in Orange County, California. “It would increase the standard for bringing a disparate impact suit to the point that it would become, in practice, close to impossible to do so.”

U.S. Sen. Tammy Duckworth of Illinois offers that, “the burden of proof to find a new business policy that is just as profitable as the alleged discriminatory practice falls on the victim to find. This creates a rigged system victims face by requiring them to guess the justifications a defendant might use and preemptively discredit them.”

Others, such as Clarence Stone, director of legal affairs at the Michigan State Housing Development Authority, argue that the Inclusive Communities decision does not imply or state that HUD should change its interpretation: “It is not apparent from Inclusive Communities that the majority ruling contained any criticism of the 2013 rule. Further, there does not appear to be legal support within Justice Kennedy’s opinion for certain elements in HUD’s new burden-shifting framework.”

Many comments are specifically critical of the portion of the proposed rule that would negate cases of discrimination caused by a third-party algorithm.

“The proposed defenses would create a loop-hole for banks/lenders to hide behind third-party vendors and their standard practice or used as intended model,” writes Angela Fernandez, commissioner of the New York State Division of Human Rights. “If the bank/lender is not held liable for discriminatory outcomes from an algorithm the third-party uses, then they will not have any incentive to look for a third-party that guarantees its algorithms do not discriminate.”

What do supporters say?

Supporters include other members of the general public, federal government officials and insurance industry representatives. They say the proposed rule would ease legal burdens on businesses and clarify the evidence needed to bring housing discrimination suits based on disparate impact. Another benefit, according to supporters, is that the proposed rule would avoid the possibility that a defendant might resort to using racial quotas.

Here’s that perspective in a nutshell from Tom Quaadman, an executive vice president at the U.S. Chamber of Commerce, a business lobbying group that is not part of the U.S. government:

“Uncertainty about the availability of disparate impact claims under the FHA and the contours of any such liability make it challenging for companies to understand their compliance obligations in this context. Varying regulatory and judicial interpretations of the FHA, and related statutes, further complicate these efforts. At the same time, companies have to manage the risk of unintentionally adopting quotas in the name of avoiding disparities. Adding to these challenges, companies face the threat of litigation based on indeterminate disparate impact theories. Such litigation poses reputational risk even if it is ultimately proven to have not been at fault. As a result, companies often decide to avoid undertaking beneficial new projects, offering valuable features, or developing innovative products out of fear of later being second-guessed under a disparate impact theory.”

Christopher Koback echoes some of the above, writing that the proposed rule “discourages ‘abusive’ disparate impact claims while preserving cases that are at the core of disparate impact liability.” Koback is president of the Bay Area Apartment Association, which represents landlords and property managers in Tampa Bay.

A 2017 Treasury Department report that Farías cites captures insurance industry concerns related to the 2013 HUD final rule — which, again, formalized the agency’s use of the disparate impact standard and the three-part burden-shifting test.

The 2017 Treasury report says the disparate impact standard, when applied to things like homeowner’s insurance, could lead insurers to collect and evaluate data on protected classes. That could conflict with state regulations and at least one state law against such detailed analysis of data on protected classes — and insurance companies usually can’t consider factors like race in developing their products.

The report also says that if insurers were forced to address insurance practices that aren’t intended to discriminate but discriminate nonetheless, they might have to adopt practices that are not actuarially sound, though Treasury doesn’t explicitly say why.

Sidebar: Actuarial soundness

Actuaries use data to predict risk and help insurance companies set prices for policies. The phrase “actuarially sound” can be nebulous, even to experts. A 2012 report from the American Academy of Actuaries could not identify a concise definition of “actuarially sound” in relation to property insurance.

But some clarity can be found by following the crumbs in the Treasury’s 2017 report.

That report cites a 2014 ruling from the U.S. District Court for the District of Columbia as evidence that “the rule could also impose unnecessary burdens on insurers and force them to alter practices in a manner that may not be actuarially sound.”

That ruling, in turn, relies on an affidavit from an insurance industry professional and a 2009 white paper from the Casualty Actuarial Society, a global organization that accredits actuaries.

That white paper describes “actuarially sound” like this, which it cribs from the CAS Statement of Ratemaking Principles from 1988:

“A rate is reasonable and not excessive, inadequate, or unfairly discriminatory if it is an actuarially sound estimate of the expected value of all future costs associated with an individual risk transfer.”

So, it might be said that an “actuarially sound” insurance policy is one with a risk assessment based on neutral data that anticipate costs. Actuaries base their risk assessments on statistical models that account for risks that might affect an insurance policy. For example, in an area that regularly gets tornadoes, certain roof designs may make some homes more prone to catastrophic damage than others.

Any assessment that is not cost-based is anathema to actuaries — and disparate impact “is not a cost-based concept,” according to that 2009 white paper. “If applied to insurance, a risk/rate factor will potentially be said to have a disparate impact if it more adversely impacts a protected minority class than it does the majority class, regardless of its relationship to underlying costs.”

A group of insurance trade associations further lay out the conflict they see between the disparate impact standard and actuarial soundness in a brief filed for Inclusive Communities:

“Where a particular practice would give rise to a disparate impact, insurers would have to forgo considering factors that correlate to risk, or to differentiate among insureds on the basis of factors that do not correlate to risk, in violation of sound actuarial principles.”

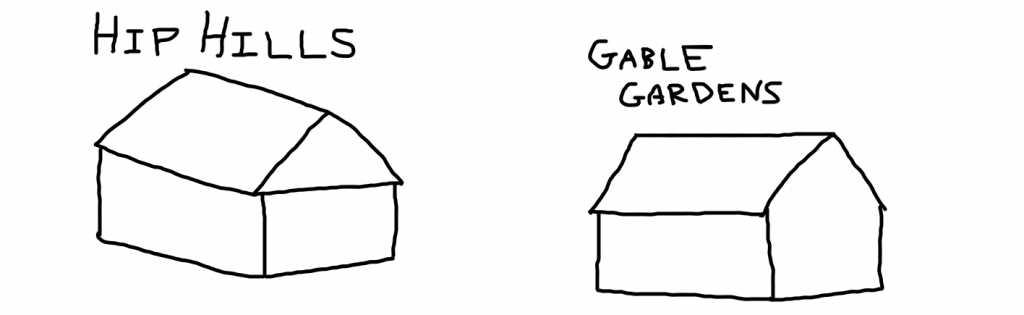

Tornado watch at Hip Hills and Gable Gardens

Here’s a simplified hypothetical to help explain this perspective:

Hip roofs are more wind resistant than gable roofs, according to research from the National Wind Institute at Texas Tech University. Hip roofs have four sloping sides. Gable roofs usually have two sides and an A-shape.

Say there are two subdivisions near each other in a tornado-prone area. Homes in both subdivisions are all worth about the same. We’ll call one subdivision Hip Hills because the homes in it have hip roofs. The other we’ll call Gable Gardens, because the homes there have gable roofs.

An insurance company in the area is selling coverage that would reimburse homeowners for catastrophic tornado damage. State law says homeowner’s insurance policies have to be actuarially sound. Among other risk factors, actuaries at the insurance company account for roof design. Insurance policies end up costing more for people in Gable Gardens because their homes can’t hold up to wind as well as homes in Hip Hills.

Gable Gardens also happens to be a subdivision where people predominately practice one religion — while people in Hip Hills predominately practice another religion. Someone in Gable Gardens might file a disparate impact claim with HUD alleging that even though the insurance company isn’t trying to discriminate, it is discriminating because members of their religion end up paying more for the same level of coverage.

Removing roof design from the actuarial equation might lower premiums for people in Gable Gardens, and eliminate the discriminatory effect. But those premiums wouldn’t accurately reflect the costs of providing the insurance, considering claims there are likely going to be higher. From the insurance company’s perspective, those rates wouldn’t be actuarially sound, and might not be allowed under state regulations. The core concern for insurance companies is that adding or removing calculations for reasons that don’t have to do with risk would upset actuarial soundness — and could affect their bottom line.

Actuarial soundness is part and parcel with insurance companies’ profit motive.

“Insurers make actuarially based decisions that are associated with risks of future losses,” the insurance associations write in the Inclusive Communities brief, in which they argue that disparate impact claims should not be allowed in cases where otherwise neutral insurance practices result in discrimination. “An insurer’s profitability, ability to offer insurance to customers going forward, and very solvency depend on its ability to match price with risk.”

It bears reminder that under HUD’s current three-part burden-shifting test, “insurance practices that have a disparate impact on protected groups are generally permissible if no less discriminatory alternative is available,” according to a 2017 paper from the Journal of Empirical Legal Studies.

As in the tornado alley example above, some states do require that certain property insurance rates be actuarially sound. An insurance company may not be able to sell insurance in those states if its rates are not actuarially sound. What Treasury is saying in its report, and what HUD is saying in its proposed rule, is that the disparate impact standard — as HUD interprets it today — could force insurance companies to pursue business decisions that would threaten their existence.

The proposed HUD rule, the 2017 Treasury report and the insurance associations’ Inclusive Communities brief all deal in legal hypotheticals. None provide examples of or allude to insurance companies pursuing actuarially unsound practices in real life due to the 2013 HUD final rule.

Neither has the property and casualty insurance industry writ large appear to have suddenly started operating at a loss. The industry wrote $613 billion worth of premiums and netted $60 billion in income after taxes in 2018, compared to $497 billion in premiums and $56 billion in net income in 2014, according to data from ISO, an insurance data provider. Net income after taxes for the industry was lower in 2012, at $35 billion. There are many factors that can affect net income. A particular year may see more hurricanes and wildfires and floods, running claims higher. But there was no obvious seismic drop in net income following HUD’s 2013 rule, as far as the entire property and casualty insurance industry is concerned.

State regulation over federal legislation

HUD wrote in 2016 that the insurance industry’s issues would be best addressed on a case-by-case basis. Any blanket exemption or “safe harbor” for insurance companies from the disparate impact standard would be “inconsistent with the broad fair housing objectives and obligations embodied in the [Fair Housing] Act,” the agency asserted then.

HUD now proposes to add language explicitly saying that the FHA would not apply to situations where it would “invalidate, impair, or supersede” state insurance regulations. “Under these circumstances, the state insurance law governs,” Farías writes. She continues that this language, “does not provide the safe harbor for insurance,” but, “would have a similar effect to a safe harbor, in appropriate circumstances.”

For example, the circumstance cited elsewhere in the HUD proposed rule — and in the 2017 Treasury report, and in the insurance associations’ Inclusive Communities brief — in which an insurance company is sued under disparate impact despite trying to comply in good faith with state regulations. HUD also seeks to affirm that “case-by-case adjudication” is the proper way to handle such situations. What is new is the explicit language that state insurance regulations would supersede federal civil rights legislation, language HUD says is consistent with the McCarran-Ferguson Act of 1945. This act delegates federal regulatory and taxation authority over insurance business to the states. The insurance associations also lean heavily on McCarran-Ferguson in their Inclusive Communities brief.

What’s next?

HUD may issue a final rule that would codify its new interpretation of the disparate impact standard. The final rule would be just that — a final rule. It would broadly describe the public comments related to the proposed rule and, to some degree, it would take those comments into account. It might end up looking different from the proposed rule. A final rule would be HUD’s last word under the current administration as to how it interprets the disparate impact standard.

It’s unclear when a final rule might be published, given that HUD staff have an inordinate number of comments to sift through. The 2013 HUD final rule on the disparate impact standard came 15 months after the proposed rule, which had roughly 100 comments.