According to the Environmental Protection Agency, U.S. residential and commercial buildings were the source of 11% of the country’s greenhouse gas emissions in 2011. The sector’s total emissions were 735 million metric tons that year, down 10% from a peak of 747 million metric tons in 2008. While much of this decrease can be attributed to the economic downturn — total greenhouse gas emissions also fell 10% over the same period, from 7 to 6.7 billion metric tons — longer-term trends indicate other factors could be at work. In particular, 2011 residential and commercial emissions (735 million tons) were nearly identical with the numbers from 1990 (733 million tons), despite a 25% increase in U.S. population (from 250 to 312 million).

Improving the energy efficiency of existing residences got a boost from the 2009 American Recovery and Reinvestment Act, which dedicated $5 billion to green retrofits. Speaking at a Home Depot in that year, President Obama called home insulation “sexy” and said the program would both boost job-creation and cut energy costs. And long before the Great Recession, the U.S. Department of Housing and Urban Development was promoting “energy-efficient mortgages,” which allow homeowners to borrow additional funds for home improvements that will reduce long-term costs. A similar program is being considered in the U.S. Senate.

Standards for energy efficient renovations and new construction have also been developed, including Leadership in Energy and Environmental Design (LEED) and the Green Globes. An even more demanding set of standards, the Living Building Challenge, requires buildings to be self-sufficient in both energy and water. Keying off such programs, a number of U.S. states and municipalities now offer tax credits for green construction and renovation. Some are modest, others ambitious, but the potential is considerable: Research has shown that economic returns on energy-efficient buildings can be substantial, even during difficult economic times.

A 2013 study from Florida State University, “Green Building Geography Across the United States: Does Governmental Incentives or Economic Growth Stimulate Construction?” attempts to better understand the ability of tax incentives to encourage environmentally friendly construction by non-governmental organizations. The researchers, Darren A. Prum and Tetsuo Kobayashi, based their work on more than a decade’s worth of LEED and Green Globes data for new buildings in six states — Maryland, Nevada, New Mexico, New York, Oregon and Virginia. From 2000 through 2012, the total number of certified buildings constructed was 10,925 — 10,792 under LEED and 133 with the Green Globes program.

The study’s findings include:

- The standards that projects must meet and the incentives provided varied greatly between states. Starting in 2000, New York offered tax credits to buildings that met the state’s own green-building standards. Oregon and Maryland’s programs, launched in 2001, required that projects attain LEED Silver status or higher. Because Nevada does not have a sales tax, starting in 2005 it began to offer reductions in sales taxes on building materials and allow for a 50% decrease in property taxes over a 10-year period.

- Most of the certified buildings were constructed in urban areas. For example, in Maryland they were in the Washington D.C. and Baltimore areas; in Nevada, most were constructed in Las Vegas and Reno; in New York State they were primarily in New York City, but also Albany, Syracuse, Rochester and Buffalo.

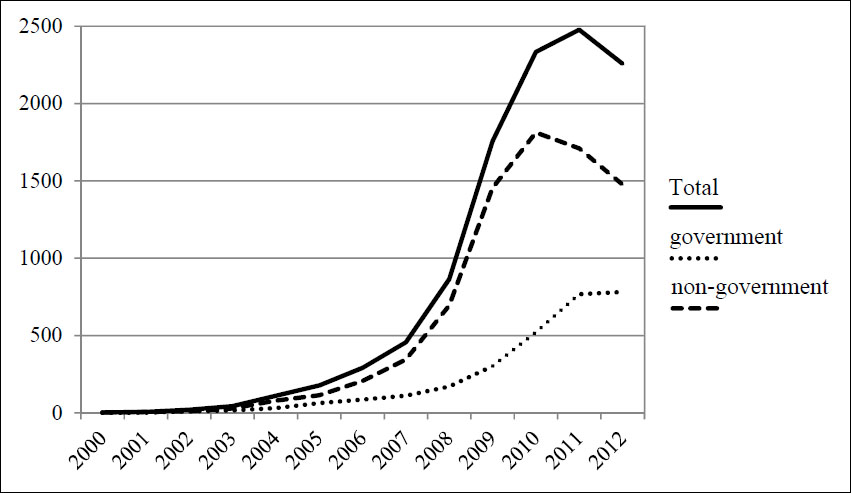

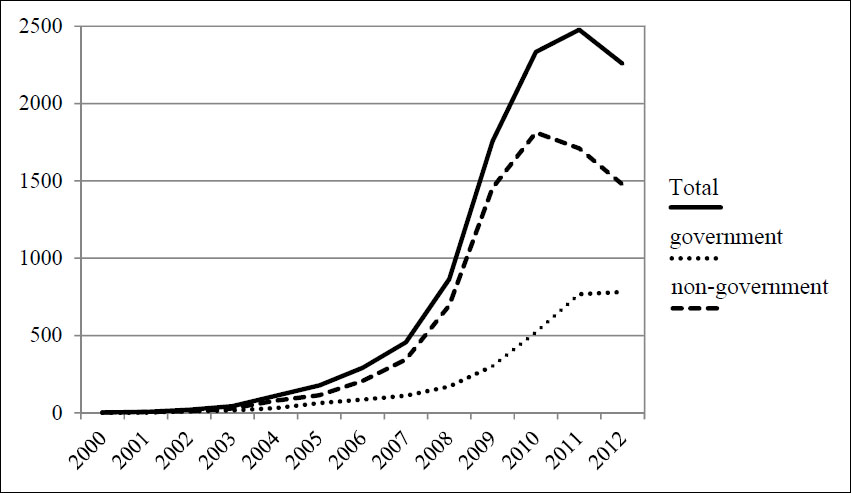

- The rate of increase prior to the financial crisis was strong: Initially 28 buildings in 10 states gained certification; the number increased to 43 in 2003, 110 in 2004, and more than 1,500 in 2009. “The trend turned downward in 2010 with an even more significant decrease for the non-government owned structures due to the impact of the economic recession that began in 2008.”

- There were periods when the construction of green buildings increased at the same time as green-building incentives were in place — for example, from 2001 to 2010 in Maryland. Overall, however, most of the states except for the Commonwealth of Virginia experienced a decrease in the number certified buildings as the financial crisis took hold.

- In Virginia, unlike other states in the study, the number of the non-government certified buildings constantly increased while showing little to no effect from the 2008 recession. One possible factor is that the state allows each local government to create its own separate incentive through property tax abatements.

- Analysis indicates that the construction of green buildings is positively correlated with gross domestic product: For every additional $1 billion dollars in national GDP, an additional 1.044 LEED or Green Globes buildings were constructed. “This result leads us to conclude that the economic factors stimulate the growth in the number of certified green buildings rather than under the tax-incentive programs considered by this study.”

- “Growth in New York is rapid due to its high amount of GDP. For example, GDP in Oregon increased $9.5 billion, from $185.2 (2010) to $194.7 (2011) while the GDP in New York increased $29.1 billion dollars from $1,128.8 (2010) to $1,157.9 (2011). This results in constructing 6.8 new buildings in Oregon while 7.7 buildings in New York. Thus, the total amount of GDP is a significant factor in the decision to construct a green building.”

“The regression analysis between GDP and the number of certified non-government green buildings shows a positive correlation between the two in all six states and the nationwide data set,” the researchers state. “This result leads us to conclude that the economic factors stimulate the growth in the number of certified green buildings rather than under the tax-incentive programs.” The researchers also note that to encourage energy efficiency, building attributes aren’t sufficient in and of themselves: Other factors such as siting, water efficiency, location and transportation availability, and regional priorities need to be taken into account as well.

Related research: A 2013 study from the University of California and Maastricht University, “The Economics of Green Building,” looks at a cross-section of commercial structures and finds that economic returns to energy-efficient buildings can be substantial. Attributes assessed include thermal and energy efficiency as well as sustainability, and the study looks at how these can contribute to premiums in rents and asset values. Also of interest is a 2012 study, “The Unintended Consequences of Greening America,” which explores the dynamics between local, state and federal regulatory systems and the possible exacerbation of class segregation.

Keywords: renewable energy, conservation