People are unlikely to bet against their own preferences in sports or politics, new research suggests, even when such “emotional hedging” may be in their interest.

The issue: Imagine you are offered to bet against your ideal political candidate or favorite team — to bet the Yankees will beat the Red Sox when you are an incorrigible Sox fan, for example, or your favorite politician for president. What’s more, the bet is free. No need to lay out any cash; there’s no risk to you.

Would you take the bet? Most Americans would not.

Such a wager is sometimes called “emotional hedging.” If the Red Sox lose, at least you’ll collect some cash, which should reduce your disappointment.

Betting only on your favorite may maximize your gains – if the Red Sox win, you enjoy cash as well as the satisfaction of seeing your team win. But it also risks maximizing your losses – if the Red Sox lose, you get no cash and a heap of disappointment.

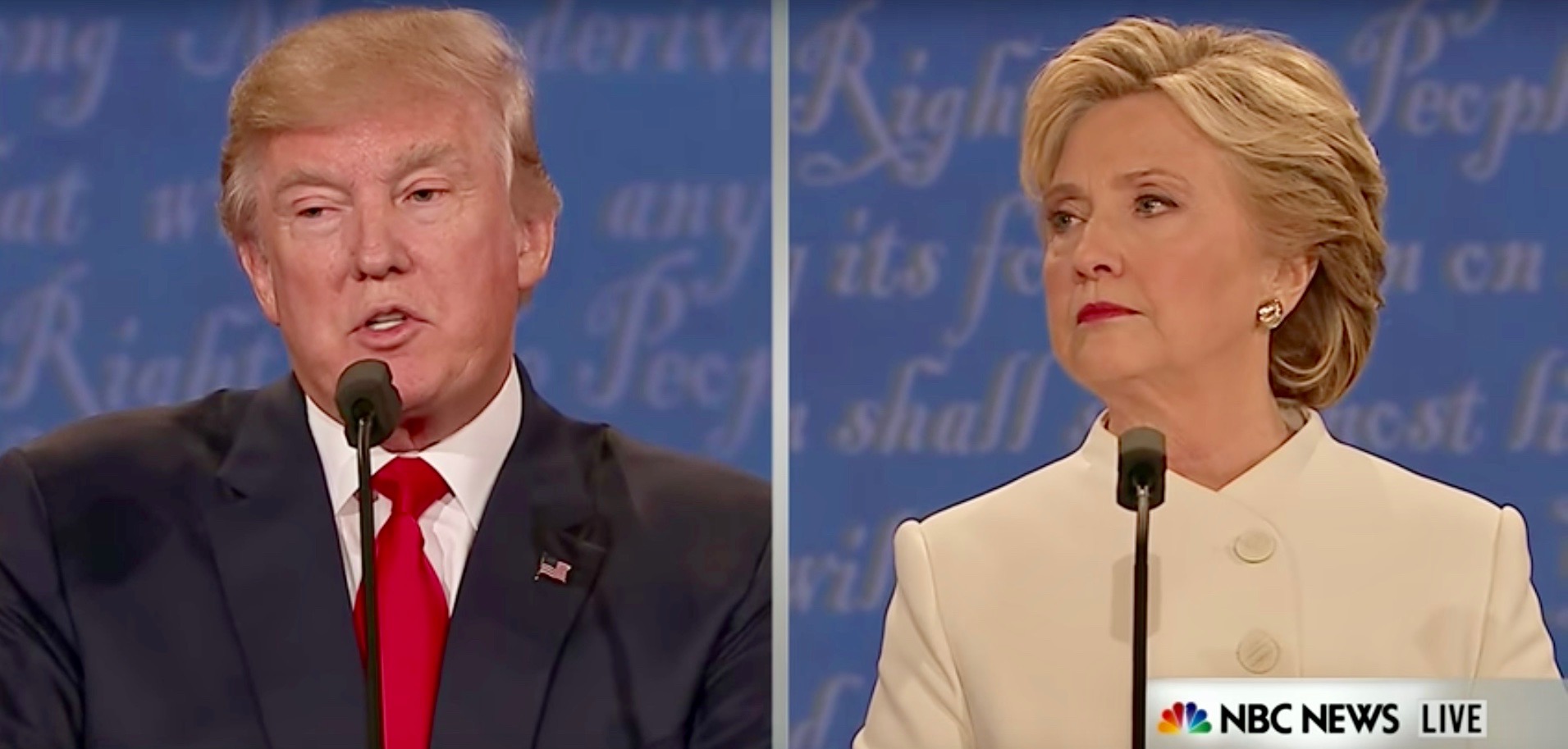

Anyone who closely identified with a candidate in the recent presidential election may recognize the quandary. Many supporters of one candidate could not fathom their contender losing, and may even have exaggerated the threat of the other winning, a new paper suggests.

An academic study worth reading: “Betting Your Favorite to Win: Costly Reluctance to Hedge Desired Outcomes,” published in Management Science, 2016.

Study summary: Researchers at Boston University and Duke’s Fuqua School of Business design six tests to see if people seek emotional hedges to “offset the potential disappointment of an undesirable future outcome.” The tests hinge on presidential elections, baseball, American football and several college sports. The researchers control for wishful thinking, the rewards offered, superstitions and moral aversion.

They believe people will not bet against something that is central to their identity, that the way their identity is associated with a team or candidate “introduces a disincentive to hedge,” a “motivational conflict.”

Findings:

- “A majority of participants preferred to increase potential gains and losses by betting on their candidate or team to win rather than reduce potential losses and gains by betting on their candidate or team to lose.”

- A reluctance to hedge is not based on fear of reprisals, but rather something more like hesitation to accept winnings earned through disloyalty.

- “A reluctance to hedge is not due to the act of violating a social norm by placing a monetary value on a relationship.”

- There is no evidence this reluctance is based on superstitions or a “moral aversion to profiting from suffering,” though it is possible that betting against one’s team feels like a moral transgression.

- Fans had no reluctance to gamble on the suffering of the opposing team’s supporters.

- Likening such hedges to insurance did not undo fans’ reluctance. Insurance – though it is an example of hedging against an undesirable outcome – is different. You “lose” the cash you pay for fire insurance premiums, but acknowledge those payments are better than losing your whole house to conflagration. This kind of hedging does not impact your emotional identity. A house on fire is bad. Period.

- This reluctance leads to riskier behavior – people put “all of their eggs in one basket.” People may forego “substantial economic incentives,” for example by failing to diversify their stock portfolio.

Other research:

Journalist’s Resource has reviewed papers on how young gamblers are more likely to engage in high-risk behavior and on who plays the lottery, and why.

Powerful people are more likely to act on their decisions than those who are ambivalent, but people who are both powerful and ambivalent are less likely to act than those who feel powerless, suggests a 2016 paper in Psychological Science.

This classic paper in the Journal of Economic Perspectives explains risk aversion.

Keywords: Hedging, decision making, elections, voting, betting, gambling, behavior