The gap between economic theory and practice is sometimes cavernous. According to one theory, developed financial markets and access to lenders should make it easier for people to borrow money, become entrepreneurs and move to higher income brackets. But new research in the Journal of Policy Modeling finds that, in practice in the U.S., income inequality increases as financial markets develop.

“We find that financial development positively affects income inequality,” the authors write. “A linear relationship exists in 50 U.S. states between financial development and income inequality.”

Many studies that look at the consequences of financial development compare data across countries. But cultural and political differences that are difficult to measure can sometimes skew results. By looking across states within the U.S., those differences may be minimized, explains Stephen Miller, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas and one of the paper’s authors.

As a proxy for financial development, the authors use a ratio of per-capita stock market wealth to per-capita personal income, neither adjusted for inflation. Stock market wealth refers to household financial wealth measured through assets like corporate stocks, pension fund reserves and mutual funds. The ratio is “a proxy trying to capture” some measure of access to capital, Miller says.

To measure income inequality, they look at three measures — the Gini coefficient, a widely used measure of household inequality, and the share of the population in the top 10% and top 1% of income. The data cross five decades, from 1976 to 2011.

Inverting Kuznets

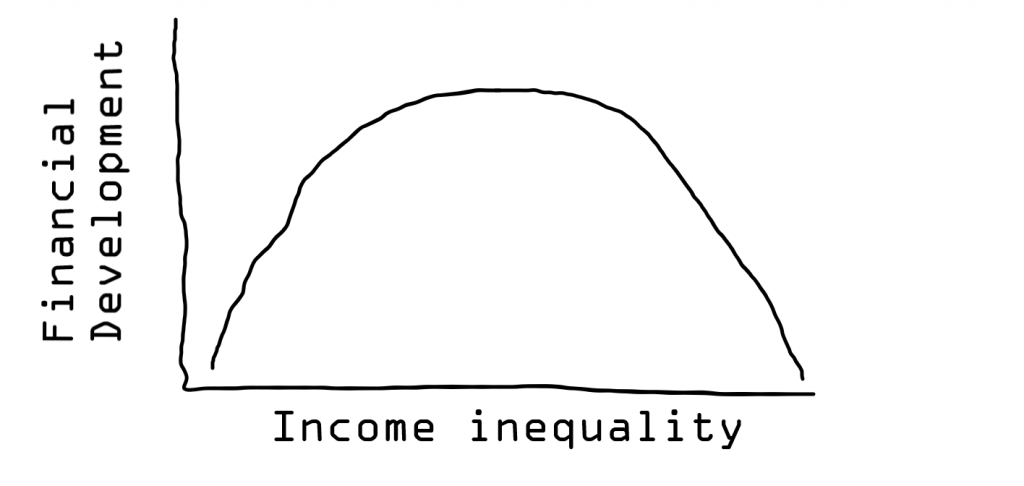

Again, the relationship between financial development and income inequality that the authors find is linear. Visually, the relationship resembles a line. Plotting the data for all 50 states would produce a graph that looks something like this:

It’s important to note that the authors of this paper are looking at decades-long trends within a specific time frame in an advanced economy. The linear relationship they find runs counter to the Kuznets curve, which is based on a longstanding hypothesis that economist Simon Kuznets developed more than half a century ago.

The Kuznets curve is an inverted U-shape that demonstrates Kuznets’ hypothesis on the relationship between economic growth and income inequality. It shows how income inequality changes as economies move from agrarian, to industrial, to post-industrial. It looks something like this:

Kuznets speculated that as economic markets develop, inequality rises but later falls. That’s because in less-developed economies, fewer people have initial access to capital. Most people might be farmers, for example, and not live near cities where finance is developing. But as an economy industrializes, more people gain access to capital to start businesses. Wages rise and inequality decreases.

“The early stages of development and growth lead to inequality but the economy, when it continues to grow, eventually drives down inequality,” Miller says, explaining the Kuznets curve. “So the idea is: don’t be concerned with inequality, it’s necessary to start the growth process. But, eventually, it will turn around and have some correction.”

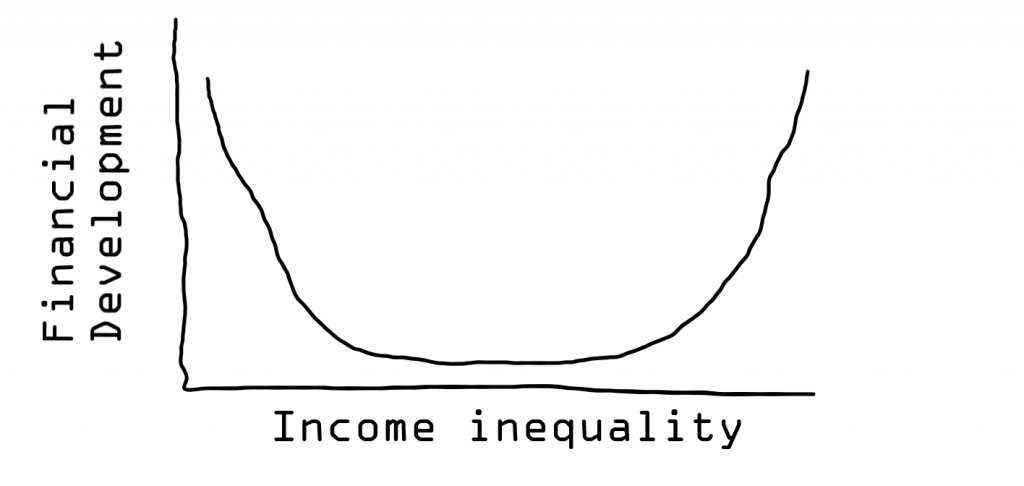

A different relationship between financial development and inequality emerged when the authors drilled down and split the country into states with above-average income inequality and those with below-average inequality. The Kuznets curve showed up for states with below-average inequality. But states with above-average inequality had a U-shaped curve. Income inequality decreased as financial markets developed, then increased as those markets matured. For above-average states, the curve looks something like this:

It matters where states start from

These different relationships might have to do with extensive and intensive margins, according to the authors. Extensive margins relate to whether poor people have access to or use financial markets. They describe the extent to which people have access to capital — a measure of quantity. Intensive margins focus on the behavior of wealthy people who already use financial products. They describe the intensity with which people use financial markets — a measure of degree. The authors explain that, “the benefits of improving the quality of the financial system may disproportionately benefit the wealthy, which tends to increase income inequality.”

For states starting with below-average inequality — states with a relatively small gap between the highest and lowest earners — the wealthy tend to initially benefit from a growing and improved financial market. The poor see benefits later. That’s the Kuznets curve.

But the poor generally seem to benefit from financial development right off the bat in states with above-average inequality, this new research finds. In the long run, however, the wealthy benefit more from ongoing improvements to the financial system. Though the authors don’t analyze outliers, a small number of anomalies among above-average states — for example, a handful that have especially wide income inequality gaps — might explain why this group flips the Kuznets curve, Miller says.

“That’s pure speculation on my part,” he adds.

States may aim to reduce income inequality by helping the poor gain access to financial markets. Whether a state starts out more or less equal could make a difference as to whether that access helps close income inequality gaps.

“Whether such policies actually reduce or increase inequality depends on the individual characteristics that determine whether a state experiences above or below average inequality in the first place,” the authors write. “Our results suggest that such policies more likely achieve the expected outcomes in below-average inequality states.