The Earned Income Tax Credit is one of the largest anti-poverty programs in the United States: In 2010 approximately 27 million families and individuals qualified, and more than $59 billion in tax benefits were distributed. Research has found numerous positive effects from the EITC, including reduced poverty, better health and even lower rates of smoking and reduced depression for some parents. Long-term benefits for children are noteworthy, particularly improved math and reading skills.

Economist Raj Chetty of Harvard University has been involved in a number of studies looking at the long-term effects of the Earned Income Tax Credit. A 2011 study by Chetty, John N. Friedman of Harvard University and Jonah Rockoff of Columbia University found that children whose parents received EITC benefits had a higher probability of attending college and earning more than they would have otherwise. A 2012 study from Chetty, Friedman and Emmanuel Saez of UC Berkeley looked at how knowledge of tax policies could affect recipients’ earnings.

The most recent study, from 2013, “The Economic Impacts of Tax Expenditures: Evidence from Spatial Variation across the U.S.,” is part of the Equal Opportunity Project. It looks at intergenerational income mobility — the chance of a child from the bottom fifth of income rising to the top fifth by the time he or she is an adult. The researchers were Chetty and Nathaniel Hendren of Harvard University; and Saez and Patrick Kline of UC Berkeley. (All are affiliated with the National Bureau of Economic Research.) They based their research on anonymous earnings records from millions of U.S. families with children born in 1980 or 1981 and who were citizens as of 2013. The parents’ 1996-2000 pre-tax income was compared with that of their children in 2010-2011, when they were approximately 30 years old.

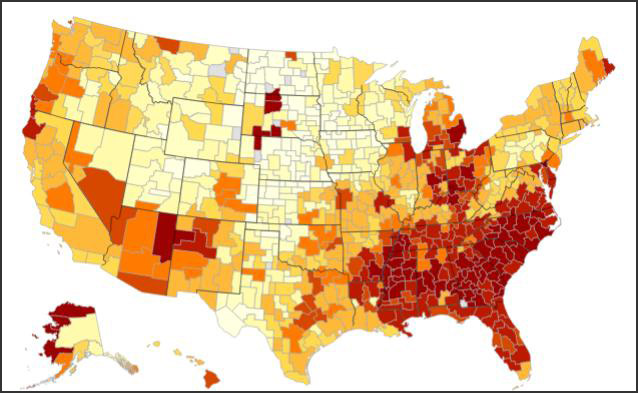

Families were grouped in 741 zones based on commuting patterns, and the researchers analyzed two factors: First, “relative mobility,” which was economic outcomes for children from high- and low-income families. Second, “absolute upward mobility,” which was economic outcomes for children whose parents earned approximately $30,000 a year and thus were eligible for EITC and the Child Tax Credit. “Hence, our statistics measure how well children do relative to those in the nation as a whole rather than those in their own particular community,” the researchers states. (In the chart above, relatively high mobility is shown as tan; low mobility is red.)

“Tax expenditures” are defined primarily as tax write-offs that individuals and families can take on their federal taxes; in effect, these “hidden” social programs embedded in the tax code represent a form of federal government spending.

The study’s findings include:

- When all other factors are controlled for, the data show that several specific types of tax policies help promote mobility. These include: more progressive state income taxes; mortgage interest deductions for homeowners; and state EITC policies. Overall, the data show that “tax expenditures aimed at low-income taxpayers can have significant impacts on economic opportunity. Hence, the short-term fiscal gains from reducing such expenditures must be weighed against the potentially large long-term costs of reduced income growth for low income individuals.”

- However, some demographic, geographic and local structural factors heavily influence mobility, as well. For example: While a high concentration of income in the top 1% did not show a significant relationship with mobility patterns, areas with a smaller middle class and more income segregation had lower rates of upward mobility. “Areas in which low-income individuals were residentially segregated from middle income individuals were also particularly likely to have low rates of upward mobility.”

- Education played a significant role in mobility: “The quality of the K-12 school system also appears to be correlated with mobility: areas with higher test scores (controlling for income levels), lower dropout rates, and higher spending per student in schools had higher rates of upward mobility.”

- Other factors than contributed to intergenerational mobility included social capital and indicators of family structure. “For instance, high upward mobility areas tended to have higher fractions of religious individuals and fewer children raised by single parents.”

- Factors that did not play a significant role in income mobility were the local cost of living, racial characteristics and economic growth rates. “We do find higher rates of upward income mobility in areas with high rates of economic growth over the past decade, but the vast majority of the difference in mobility across areas is unrelated to economic growth.”

- The top three cities with the highest intergenerational mobility were Salt Lake City (11.5% odds of a child from the bottom fifth rising to the top fifth); San Jose, Calif. (11.2%); and San Francisco, Calif. (11.2%). Boston, Mass., was ninth at 9.8%, while New York City’s rate was 9.7%.

- The cities with the least generational mobility were Atlanta, Georgia (4.0%); Charlotte, North Carolina (4.3%); and Indianapolis (4.8%). All three were lower in the mobility ranking than Detroit, in 47th position at 5.1%.

- Atlanta’s position at the bottom of the mobility scale is notable given that the city is in the Sun Belt and has high population growth rates. Despite its economic prosperity, Atlanta has relatively high levels of income segregation, fueled by the metropolitan region’s sprawl — 8,376 square miles — and has a strong negative effect on intergenerational income mobility.

- The differences between cities at the top of the scale and those at the bottom were profound: “Some areas have rates of upward mobility comparable to the most mobile countries in the world while others have lower rates of mobility than any developed country for which data are currently available.”

“What is clear from this research is that there is substantial variation in the United States in the prospects for escaping poverty,” the researchers state. “There are some areas in the U.S. where a child’s chances of success do not depend heavily on his or her parents’ income. Understanding the features of these areas — and how we can improve mobility in areas that currently have lower rates of mobility — is an important question for future research.”

Related research: A 2013 study in the Journal of Economic Perspectives, “Income Inequality, Equality of Opportunity and Intergenerational Mobility,” looks at the relationship between intergenerational mobility and inequality, as measured by the Gina Coefficient. “The goal is to explain why America differs from other countries, how intergenerational mobility will change in an era of higher inequality, and how the process is different for the top 1 percent,” writes the study’s author, Miles Corak. A post by Justin Wolfers in the Freakanomics blog, “Is Higher Income Inequality Associated with Lower Intergenerational Mobility?” looks at questions that Corak’s study addresses.

Also of interest is a study by Chetty, Friedman and Rockoff, “Long-Term Impacts of Teachers: Teacher Value-Added and Student Outcomes in Adulthood,” looked at “value added” test scores to explore the impact of instructors — high and low quality — on students’ lives after they leave school. They found that having a better teacher for a single grade increases by 0.5 percentage points a student’s probability of attending college by age 20. Having a better teacher for a single grade also increased a student’s earnings at age 28 by 1%.

Keywords: poverty, sprawl, segregation, intergenerational mobility